In today’s big data world, the security of data and reliable propagation of this data to its final destination is the need of the hour. This immense requirement has itself led to a blockchain revolution in as short a span of time as one year. In fact, the blockchain demand and its revolution can be justified easily by the Google request for the keyword “blockchain” which has surprisingly increased by 250%.

Blockchain creates a common digital platform that can be described as a transaction ledger and information shared by different parties can be stored in blocks without being edited, changed, or adjusted by any party. In the simplest terms, the literal meaning of the words “block” and “chain” is:

BLOCK – digital information

CHAIN – stored in a public database

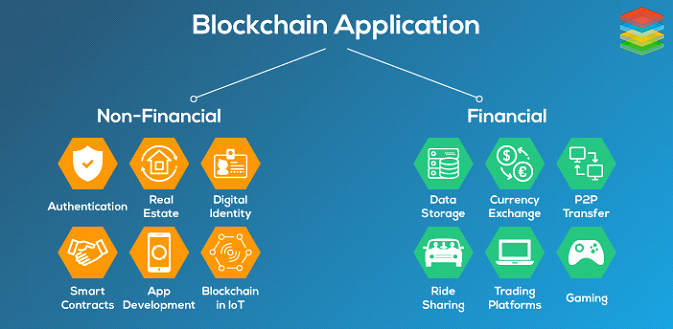

Factors like security, speeding up the business, compliance, investment, and venture capital funding are driving the blockchain market. The immense use of blockchain solutions in cybersecurity, IoT, and banking by government efforts is promoting market growth in this domain.

Image source: https://www.xenonstack.com/blog/devops/blockchain-technology-decentralized-applications/

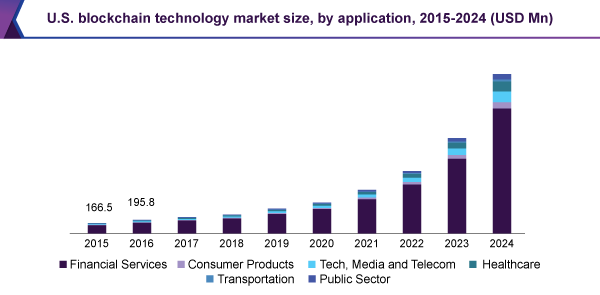

Looking at these humongous applications and prodigious add-ons of using blockchain, it’s no surprise that the amount of money invested in blockchain by total corporate and government was predicted to hit about $2.9 billion in 2019, which is an increase of 89% as compared to the previous year, and about $12.4 billion by 2022.

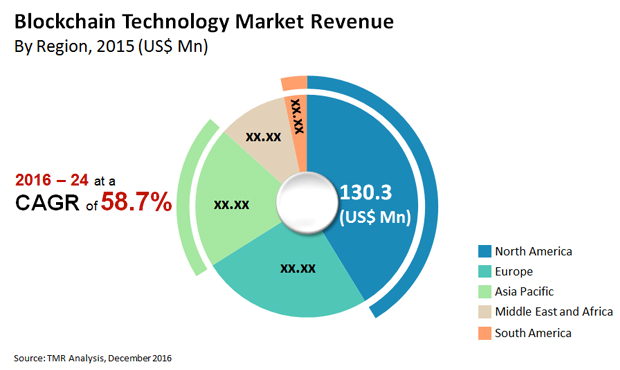

Looking from the global market perspective, North America holds the major market share and some of the key players working in blockchain are companies like Microsoft, Deloitte, AWS, Oracle, SAP, IBM, etc. Out of the global revenue generated through blockchain, around 40.9% is contributed by North America alone.

In eastern countries like India and China, the financial sector is adopting blockchain at the fastest rate. In China, bitcoin is becoming very popular and it is expected to increase the Asia Pacific market domains as well. Economic development in countries like India, China, and Japan has accelerated the pace of blockchain adaptation with the prediction that there will be growing investment in this technology in the near future.

Image source: https://www.grandviewresearch.com/industry-analysis/blockchain-technology-market

Image Source: TMR Analysis

In India, leading IT companies like Tata Consultancy Services (TCS) are confident that this year will be the most profitable year for blockchain as it will be adopted largely by banks and the stock exchange. One interesting step taken by ICICI Bank is that it has pulled more than 250 corporates on its blockchain stage for domestic as well as international financial trade.

A large number of start-ups dominate the blockchain market, making it a fragmented one. These start-ups use the strategy of increasing its market share through collaborations and partnerships. In 2017, more than 60% of the market share was captured by start-ups. For example, in 2018, R3 collaborated with HSBlox, which offers services in the healthcare sector in order to progress blockchain in the Healthcare industry. On the other hand, multinational companies have strategies like mergers and acquisitions to upgrade technical expertise, product portfolio, talent, and most importantly, to provide a competitive edge. For instance, in 2018, IBM created a joined venture with Maersk to implement blockchain in the supply chain, improving global trade.

Among the public, private, and hybrid sectors, the public sector is the most popular in adopting blockchain technology at a faster rate with the aim to create transparent and efficient transactions.

For instance, the Australian Securities Exchange (ASX) announced that they will be moving the Australian clearing and settlement systems on the blockchain platform.

Blockchain surely holds a strong market and it is expected to grow at a great rate in the coming years. The Asia-Pacific region is expected to surpass others in adopting blockchain, specifically in the financial sector.